A 2025 Shopping Rubric for Baddies on a Budget

Hop in my salon chair while I yap about how to be a baddie on a budget.

INT. BLOOMINGDALE’S - DAY

CHYRON: 2022

Neima waltzes through the sunglasses section on her 15 minute break from the low wage job she took during the writers strike to not go broke. Ironically, with one purchase, she’s about to do exactly that.

PHOENIX: The Celine’s look weird with your face shape.

Her best friend, over FaceTime, is encouraging her impulse decision.

NEIMA: Okay, then. Prada it is.

Neima takes in the black acetate sunnies one last time, then gives her sales rep a final nod.

She quickly taps her Apple Pay before overthinking her mistake and hustles back to her retail job, Bloomingdale’s bag in hand.

Subtle foreshadowing: It takes her a year to pay that off on her credit card.

Thanks to my die hard Who What Wear obsession, a Mary-Kate and Ashley movie, and The Hills casts’ Teen Vogue internship, my middle school dream was to work in fashion. I started sketching designs and had plans to move to New York after high school.

I let it go over the years as I discovered other obsessions, but the passion never faded.

So, when the film and television industry got slow, I used it as an excuse to finally dip my toe in fashion and be a stylist at a store in Century City. (I will not name the store that plays really loud music and has a fitting room line as long as Space Mountain).

The downside? I was always surrounded by clothes. And what happens when you’re surrounded by clothes?

You want them. And you buy them.

So, after two impulse purchases, one painted above, I developed this system to keep my shopping in check and not be wooed by my employee discount.

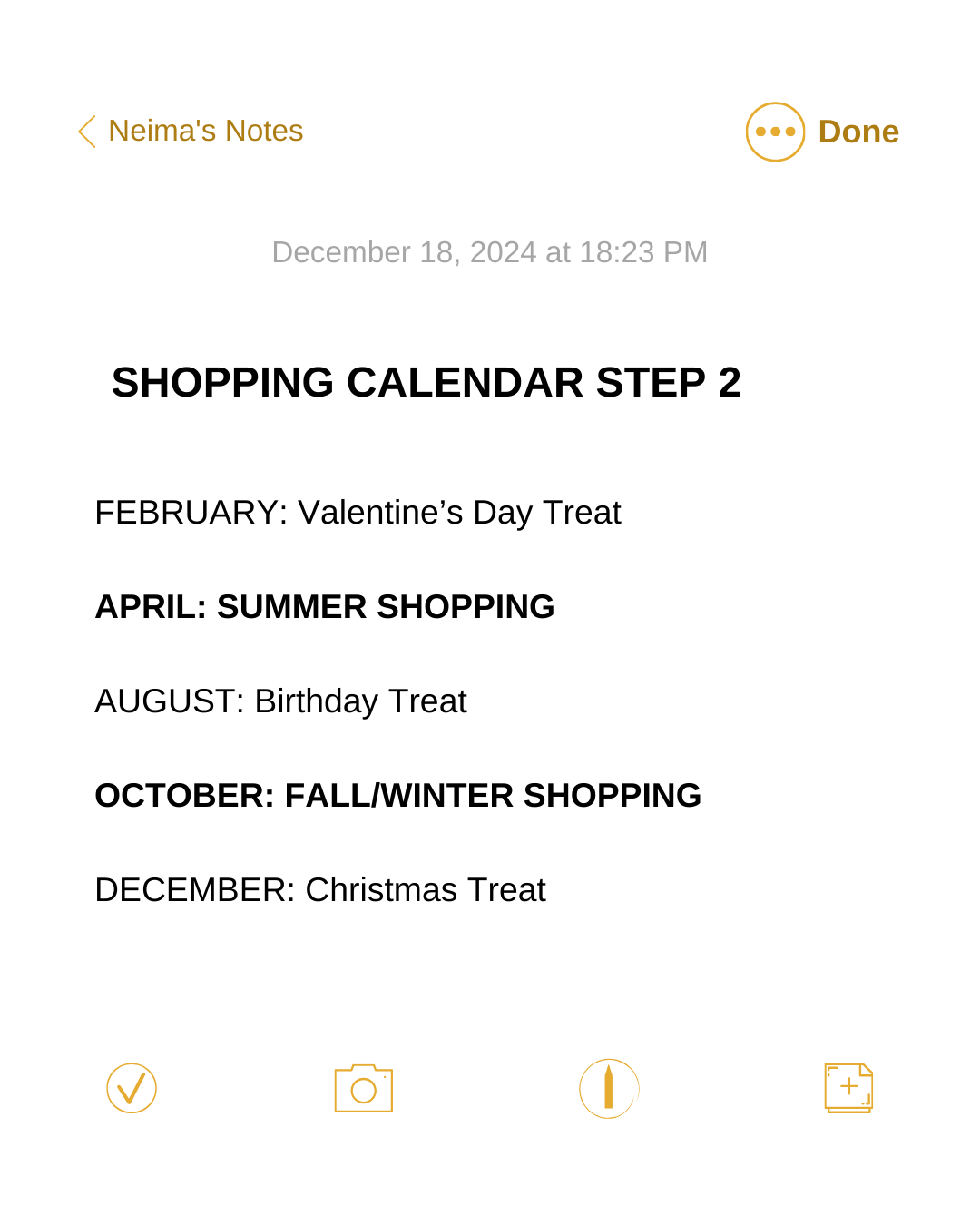

First, we develop a Shopping Calendar.

We mark key dates when we would spend money, i.e. holidays, travel, and important birthdays.

Then, we use that process of elimination to select two months when we are allowed to shop and a few holidays we’ll allow ourselves a little gift.

I will start this off by saying that other than those two impulses, I’m actually pretty disciplined and Type A with money. So, once I set a rule for myself, I stick to it. You have to stick to this for it to work, okay?

Pinky promise?

Let’s continue.

Second, we identify closet holes.

Using Pinterest, we can easily analyze our heart’s deepest desires. So, here’s a screenshot of my STYLE Pinterest board. It’s public, so boom.

A few themes we could deduce from today’s iteration of this board:

Loose fitting pants

Maxi skirts

Browns

Scarves

I’ve finally gotten to a point where I don't really need to shop in order to look like my Pinterest board. But, back then, I did. So, assuming I didn’t have all of those things, that’d mean my next shopping day should have those four kinds of items.

Third, use that Shopping List as a way to collect links.

As we online shop, we’ll drop a link in there. Screenshot below of what our SHOPPING LIST would look like at this point.

Fourth, we wait until it’s time.

While we do that, we save. Every month, we put aside a little bit for shopping so that by the time shopping month rolls around, we aren’t blowing our paycheck or running up our credit card to make purchases.

Fifth, the month has arrived.

But we don’t purchase yet! Nope. We declutter our closets!

Then, we pack up all those clothes and take them to sell at our local thrift store. We use that store credit we just got from selling to see if we can find maxi skirts, scarves, loose fitting pants, and browns.

Doing this, I’ve literally gotten a The Kooples trench (retail ~$700) for $40, Ferragamo heeled ballet flat for $65, an oversized blazer for like $20. The list goes on. And when there was store credit involved, I spent zero dollars or close to nothing.

So, say we find a maxi skirt and a scarf that we love for basically free, now we can go back to our list…

But it’s still not time to purchase!

Now, we analyze everything on our list.

Hopefully, a month or two or three has passed. And now, we have a chance to look at each item and decide whether they still resonate with us.

We should be deleting things at this point, especially because there’s a high probability that our budget won’t allow for every item anyway.

Once we do some decluttering of that list…

…then, we buy.

Bonus: Spend more to spend less.

In certain areas, you’ll get more out of your money by purchasing one high quality piece rather than having to constantly replace the low quality version.

Take perfume, for example: a good perfume will last longer because it won’t require re-applying throughout the day.

A good business suit, blazer, and trouser will also last you a while if you buy good quality. For these items, I suggest saving for longer to buy really good quality.

I hope this helps you organize your shopping and mitigate your impulse spending. Fashion is supposed to be a tad expensive. We aren’t supposed to have everything at the click of a button. Fast fashion and credit cards have us warped.

But, you can do this. You can slowly build the wardrobe of your dreams without obliterating your savings.

Share your spending oopsies below so that we don’t all feel alone.

If you loved this, hit the heart. If you relate, drop a comment. If you think the world needs this, share it.

Thanks for visiting the Njoy Salon. See you at your appointment next week!

xoxo, Neima

LOVEEEE this. Thank you.

Love this and needed! 🙌🏽